When it comes to your portfolio, it pays to be careful. You can’t risk your savings on a “hunch” or on unfounded advice. At the same time, there’s no shortage of prominent advocates for gold and silver with some huge claims about the future price of silver. There are some who believe that silver could skyrocket to $130 an ounce in only a couple of years, others who believe more modestly that silver will hit $50 an ounce by the end of 2018, and there are extremely bullish investors like Robert Kiyosaki who say silver could reach $6,000 an ounce in the long run.

There is no crystal ball for predicting silver prices, but there is history and silver price charts. There are strong arguments behind a bullish stance on silver. How high it can take silver prices is anyone’s guess, but the fundamentals of silver price growth are present. Whether it’s $50 an ounce or $6,000, when you get silver prices today you see that there’s huge potential in silver. When someone predicts silver prices of $130 an ounce in the near future, here’s what’s driving their predictions.

Silver Prices Are Undervalued

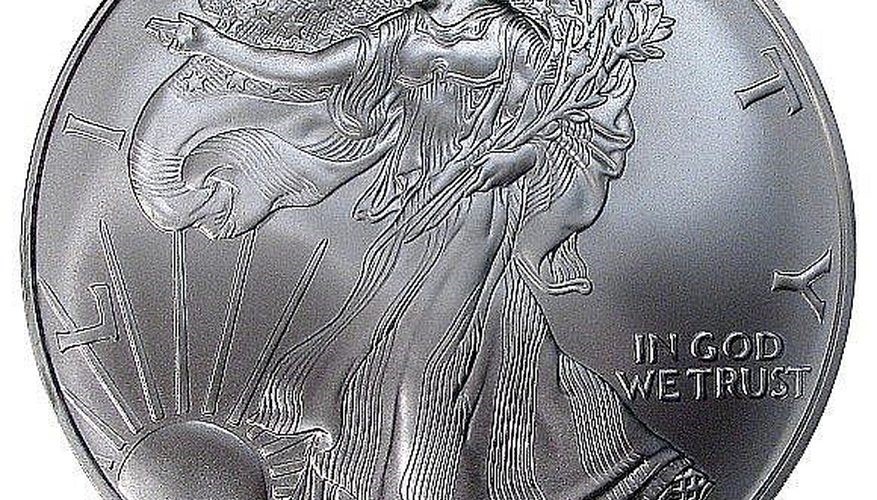

Silver is not worth as much as it should be. There are many different indicators that this is the case, from the silver-gold ratio to the silver-S&P ratio. There’s also the alarming new fact that silver has recently become rarer above ground than gold. While there is still probably more silver unmined, silver is being used by industry faster than it can be mined. The rarity of silver has quickly made silver coins and silver bars popular sellers from bullion dealers like Silver Gold Bull.

Silver Prices in the Gold-Silver Ratio

One of the biggest indicators that silver is undervalued is the gold-silver ratio. At present silver prices, the ratio is around 75 to 90. Historically, this stood around 15, meaning gold was worth 15 times what silver was worth. As far back as the Roman Empire, the ratio seems to have been around 10 to 1 (comparing silver denarii with the gold aureus), while 15 was fixed into law in the U.S. and France around the 19th century. In modern history, the ratio has been more like 65, which means even by modern standards silver is undervalued. Investors who believe a correction is imminent see silver prices rising to meet gold, rather than gold falling.

Supply Impact on Silver Prices

Many believe that silver prices are in for a big correction due to the basics of supply and demand. Mining companies have by and large fallen behind on silver production to the point where demand for silver outstrips supply. Despite silver recycling, stocks are shrinking because of it. Silver prices have yet to catch up to rising silver demand, which means mining companies aren’t searching for silver or investing in silver mines. When silver prices take off, it could take years for mining companies to catch up.

Buying silver bullion online from a bullion dealer like Silver Gold Bull is the most convenient way to buy silver right now. When you’re holding real silver bullion, you can sleep soundly knowing your money is safe. Invest in silver today and take advantage of rising silver prices, wherever they go. Just remember, making money from silver isn’t about where you sell, it’s about where you buy – and silver prices today are highly undervalued.